Clean Energy Canada | Two huge energy trends Canada can't afford to ignore

October 11, 2017

What does Canada’s energy future look like over the longer term?

It’s a critical and timely question—made even more relevant as our country, at least many of our political and business leaders, gets embroiled once again in a polarized debate about pipelines. And it’s the central topic of discussion this week at Generation Energy, an event convened by federal Natural Resources Minister Jim Carr.

From our perspective, it’s an opportune time to step back, observe what’s happening around the world and learn about new technologies and emerging global trends. Only then can we have a productive discussion about how we can best situate Canada to capitalize on the opportunities of the global transition to clean energy that’s underway, rather than falling victim to its challenges.

To discuss Canada’s energy future in this context, we need to understand two things that make this global energy transition different than any that has preceded it. First, the role of China. And second, the forces that are accelerating change.

Let’s consider China, and the images and videos of life in Beijing just a few years ago. Air so thick with smog that you couldn’t see the sun. While in Canada, we tend to talk about making the transition to clean energy as one way to mitigate climate change, cleaning up urban air pollution is one of the primary drivers of the energy transition in China. Ensuring the population can breathe has become a political imperative.

As we know, China has a command-and-control governance system and, like it or not, when they make a decision to do something—like solve the air pollution problem with clean technologies—they build it into their five-year plan, and it gets done.

Today they are installing three soccer fields’ worth of solar panels and two windmills every hour of every day. And they’ve shut down the coal-fired power plants in Beijing. There is still coal-fired power in the country, of course, but the direction they are going is clear, and they’re moving faster than anyone expected. China is now the number-one investor in both wind and solar.

China is also the world’s second-largest economy, the fastest-growing large economy, and home to the world’s largest labour force. So when China decides to dominate manufacturing, the country can deliver on a massive scale.

As China ramped up manufacturing of solar panels, economies of scale and experience helped drive the cost of utility scale solar down 60 per cent between 2010 and 2015. Suddenly this renewable technology became increasingly cost-competitive, and is now being adopted at an unprecedented rate—in China, the U.S., India, and throughout Africa.

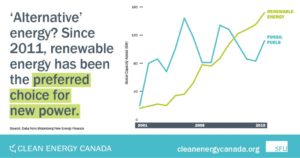

That’s tipping the scales toward renewables around the world, enough to reshape electricity trends globally. For each of the past four years, there has been more renewable electricity built than fossil fuel electricity, and that isn’t likely to change in the years ahead. China has played an outsized role in shaping this reality.

Some people say the pace of the energy transition will be slow and measured. But we’ve never experienced an energy transition in a globalized market, with a major economic actor like China, whose sheer scale can drive such rapid and fundamental change.

Further, we’ve never had an energy transition that wasn’t just a change in hardware, but one that is capitalizing on the power of software in an increasingly connected world. The imperative to decarbonize, plus the opportunity to decentralize, plus the power to digitize together act to accelerate this transition.

So in light of those factors, what might we expect from disruptive technologies in this transition?

Transportation will be a centrepiece of the energy transition and a sector where change could prove particularly disruptive, depending in part on how quickly it happens. It took 20 years to get the first million electric vehicles (EVs) on the road, but just a year and a half to get to the second million. And Bloomberg New Energy Finance projects the third million will take just under a year.

When might the world see 100 million electric cars on the road?

If your forecast is 2040 or later, it’s similar to what ExxonMobil has projected. If you think 2030, you’re closer to Bloomberg New Energy Finance. And if you’re somewhere in between, then you’re in the company of OPEC, and BHP Billiton and BP.

It’s worth noting that all of those forecasts were made before China announced last month that it is going to set a ‘best before’ date for internal combustion engine vehicles—following in the footsteps of the Netherlands and Norway, Britain and France, Scotland and India. It’s speculated China’s internal combustion engine ban could come as early as 2030—but let’s look at what Wood Mackenzie modelled out for a 2035 ban. China’s fuel demand would fall, displacing about two million barrels per day of fuel demand. And instead of having about 20 million EVs on the road, they would have on the order of 200 million. It would massively change things.

Over the past decade China played an outsized role influencing the revolution in renewable electricity—particularly when it comes to solar power. They are now poised to do the same for electric cars.

This matters for multiple reasons that are important considerations for Canada’s economy, but here are just two:

Without question, the uptake of electric vehicles is going to affect oil demand. If it happens as quickly as Bloomberg New Energy Finance expects, it will reduce oil demand in 2040 by eight million barrels per day—that’s equivalent to the amount of oil Saudi Arabia exports today. To be clear, this isn’t “the end of oil,” but oil’s dominance in transportation is coming to an end. Shell has suggested that oil demand could peak within the next decade or so.

On top of that, the growing popularity of EVs is going to create a surge in demand for the metals needed for lithium-ion batteries. It just so happens that Canada is home to many of the metals and minerals needed for these batteries, for electric cars, as well as for the LED light bulbs, wind turbines and solar panels that are all key pieces of the energy transition.

So this leads to a question for Canadians: Are we going to choose to focus on retooling our economy to be winners? Or will we remain mired in a belief that our only real asset, or aptitude, is extracting fossil energy from the earth?

Generations of Canadians stand to benefit from the global energy transition, and it’s already happening. For example, we have metals and minerals; if our mining sector is low-carbon, Canada could supply materials to build the clean energy economy. We have a very clean electricity system, and we have expertise in high-voltage transmission lines, smart grids and more—we can be among the leaders in demonstrating how to switch from fossil fuels to clean electricity. And we have an auto sector that could be retooled to make parts for electric vehicles, and build them right here.

What does our energy future look like in Canada? The short answer is, it’s up to us.

We have an opportunity to not only decarbonize our economy here in Canada, but to play to our clean energy strengths and become a leading developer of the solutions—the technologies and services—that can decarbonize, decentralize and digitize energy systems around the world.

If we are successful in doing so, Canada will be among those countries that capitalize on the immense opportunity that this energy transition offers—not just environmentally, but economically.

It’s a choice we are fortunate to have the opportunity to make, so let’s make it wisely—and let’s position Canada to thrive in the clean energy transition, not just for our own benefit, but for the generations of Canadians to come.

Co-authored with Dan Woynillowicz, policy director at Clean Energy Canada. This op-ed is based on remarks delivered by Merran Smith at Generation Energy in Winnipeg on October 11, 2017, in the panel discussion on “Next Generation Solutions for the Transition.”